"PatBateman" (PatBateman)

"PatBateman" (PatBateman)

08/12/2020 at 13:19 • Filed to: Tesla, Stonks, Ford, STOP READING MY TAGS

3

3

54

54

"PatBateman" (PatBateman)

"PatBateman" (PatBateman)

08/12/2020 at 13:19 • Filed to: Tesla, Stonks, Ford, STOP READING MY TAGS |  3 3

|  54 54 |

Let’s do some basic damned math real quick regarding Tesla stock. Note: I’m not giving you investment advice, nor is this dumb social media post an endorsement of any action on any investment product (ARE YOU HAPPY NOW, NASD?!).

Ford stock is currently priced at $7.08/share. With approximately 3,978,390,000 outstanding shares, the company has a current market cap of right at $28,167,001,200. In all of 2019, Ford produced a total of !!!error: Indecipherable SUB-paragraph formatting!!! . If we divide the total current market cap by the total vehicles sold in 2019, the company is worth $11,626.29 per vehicle sold last year.

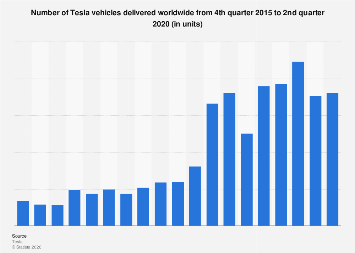

Tesla stock, in comparison, is currently priced at $1,521.60/share. With approximately 186,360,000 outstanding shares, the company has a current market cap of right at $283,565,376,000. In all of 2020 (current year used to reflect higher sales volume expectations), Tesla is expected to produce approximately !!!error: Indecipherable SUB-paragraph formatting!!! . If we divide the total current market cap by the expected total vehicle sales in 2020, the company is worth $515,573.41 per expected vehicle sold in 2020.

If we apply a value MORE THAN DOUBLE to what Ford’s market cap/vehicle sold is to Tesla’s numbers and reverse the formula:

$25,000 market cap/vehicles expected to sell in 2020

$25,000 x 550,000 vehicles = $13,750,000,000 current market cap

$13,750,000,000 / 186,360,000 outstanding shares = $73.78 stock price.

And now DIVIDE THAT BY FIVE, BECAUSE OF THE IMPENDING 5-1 STOCK SPLIT and you get a post split stock price of $14.76 per share. If the stock split happened right now, it would be $304.32 per share.

Now, some people might point to Tesla being more akin to a tech company than a car company, but if you apply P/E ratios of some of the top tech companies to Tesla stock, you get similar results. And considering that Tesla is primarily making vehicles right now and doesn’t have the parts business that Ford has (to counter the “Tesla makes batteries, too” argument)...

STONKS.

(Again, this is not advocating a position on any stock or investment vehicle, but is meant for educational purposes only).

Nibby

> PatBateman

Nibby

> PatBateman

08/12/2020 at 13:22 |

|

*ahem* good economics lesson is

GIMME ALL YOUR MONEY

if we have 50 regulars here who give me $5,000 each, that’s $250,000 that can be invested into FORD TEMPOS!

For Sweden

> PatBateman

For Sweden

> PatBateman

08/12/2020 at 13:24 |

|

If we remove single-share zoning , we can build more Tesla shares and lower the price.

PatBateman

> Nibby

PatBateman

> Nibby

08/12/2020 at 13:25 |

|

Sold. I’ll broker the deal for a 5% fee, with a $100,000 guaranteed minimum that I’ll take off the top.

PatBateman

> For Sweden

PatBateman

> For Sweden

08/12/2020 at 13:26 |

|

ROUND LOTS ONLY.

For Sweden

> PatBateman

For Sweden

> PatBateman

08/12/2020 at 13:27 |

|

Highlander-Datsuns are Forever

> PatBateman

Highlander-Datsuns are Forever

> PatBateman

08/12/2020 at 13:28 |

|

Tech stock has never made sense to me. Neither has all those fancy ways of making money using futures and bonds and other things...

I’m gonna go pan for gold. Later.

PatBateman

> For Sweden

PatBateman

> For Sweden

08/12/2020 at 13:29 |

|

Was that... Was that Doug’s... Nah, couldn’t have been.

and 100 more

> PatBateman

and 100 more

> PatBateman

08/12/2020 at 13:30 |

|

You explained this very clearly, thank you. I still don’t understand. I really need to learn. My savings account is bullshit.

SBA Thanks You For All The Fish

> PatBateman

SBA Thanks You For All The Fish

> PatBateman

08/12/2020 at 13:30 |

|

But... But.... “Giga Hyper Growth With Exponential S-Curves”...

For Sweden

> PatBateman

For Sweden

> PatBateman

08/12/2020 at 13:32 |

|

!!! UNKNOWN CONTENT TYPE !!!

PatBateman

> Highlander-Datsuns are Forever

PatBateman

> Highlander-Datsuns are Forever

08/12/2020 at 13:32 |

|

Gold? Nah, too hard on the knees. I hear the next big thing is panning for cobalt in the Congo.*

*Yes, I have been approached before by an investor looking to get into putting money into Congo cobalt mining. I then had to have a serious discussion with him about the dangers of investing money in companies like Congo while trying not to snicker.

PatBateman

> and 100 more

PatBateman

> and 100 more

08/12/2020 at 13:33 |

|

You don’t need to learn. No one but people in my industry need to learn this type of analysis. You, however, need to find a reputable financial advisor with a reputable company and follow their advice.

PatBateman

> SBA Thanks You For All The Fish

PatBateman

> SBA Thanks You For All The Fish

08/12/2020 at 13:34 |

|

Excuse me, but I don’t want curves in my future vehicle. I want a basic pyramid shape.

ttyymmnn

> PatBateman

ttyymmnn

> PatBateman

08/12/2020 at 13:34 |

|

So, in summation, is this good or bad?

My wife does the taxes. I have no idea how any of this works.

ClassicDatsunDebate

> PatBateman

ClassicDatsunDebate

> PatBateman

08/12/2020 at 13:36 |

|

I’d get into Tesla now....if all my money wasn’t tied up in Juicero.

Arch Duke Maxyenko, Shit Talk Extraordinaire

> PatBateman

Arch Duke Maxyenko, Shit Talk Extraordinaire

> PatBateman

08/12/2020 at 13:37 |

|

Tesla buys their batteries from suppliers who also supply other automotive companies. Tesla buys a lot of the parts they use on their vehicles from the exact same suppliers as every other automotive company. Unlike every other automotive company, Tesla’s stock is priced at nonsensical numbers because people pushing up the numbers are the same people who artificially inflated bitcoin values

PatBateman

> ttyymmnn

PatBateman

> ttyymmnn

08/12/2020 at 13:37 |

|

This is for educational purposes only.

However, do you think Tesla should be worth half a million dollars per vehicle sold?

ttyymmnn

> PatBateman

ttyymmnn

> PatBateman

08/12/2020 at 13:40 |

|

So, it’s good for Tesla?

PatBateman

> Arch Duke Maxyenko, Shit Talk Extraordinaire

PatBateman

> Arch Duke Maxyenko, Shit Talk Extraordinaire

08/12/2020 at 13:44 |

|

I can (legally) neither confirm nor deny your logic. :)

Arch Duke Maxyenko, Shit Talk Extraordinaire

> PatBateman

Arch Duke Maxyenko, Shit Talk Extraordinaire

> PatBateman

08/12/2020 at 13:46 |

|

I may or may not have a friend, who may or may not be a financial advisor and I may or may not work for an OEM supplier.

ZHP Sparky, the 5th

> PatBateman

ZHP Sparky, the 5th

> PatBateman

08/12/2020 at 13:48 |

|

I made a similar point recently (not quite as eloquently and as detailed as you) around P/E multiples even factoring in the tech sector...and the Tesla fanbois laughed me out of the room going “LOL P/Es? What year is it, 1995?”

Can they just admit that they’re just gambling at this point and leave it at that? I’m totally cool with that.

PatBateman

> ttyymmnn

PatBateman

> ttyymmnn

08/12/2020 at 13:48 |

|

It’s neither good nor bad for Tesla, the company. Just because the company is worth X amount of market capitalization (what it would cost to buy all of the outstanding shares of a company on the open market in one instant) doesn’t necessarily have a demonstrable difference in how the company is doing, or will do.

I guess it’s good for everyone that bought the stock at $14.98 back in 2010 and is selling right now...

fintail

> PatBateman

fintail

> PatBateman

08/12/2020 at 13:49 |

|

Be right back, selling my Bre-X stock.

PatBateman

> Arch Duke Maxyenko, Shit Talk Extraordinaire

PatBateman

> Arch Duke Maxyenko, Shit Talk Extraordinaire

08/12/2020 at 13:50 |

|

Industry knowledge and friends with other industry knowledge can be very insightful to anyone willing to open their minds to see an issue from a different perspective.

I like cars: Jim Spanfeller is one ugly motherfucker

> PatBateman

I like cars: Jim Spanfeller is one ugly motherfucker

> PatBateman

08/12/2020 at 13:52 |

|

Doncha know that Teslas are actually appreciating?

Besides, we’ve known that the entire stock market is fake and made up for a while now.

PatBateman

> ZHP Sparky, the 5th

PatBateman

> ZHP Sparky, the 5th

08/12/2020 at 13:53 |

|

There’s a reason why I’m not making this argument on the FP; I don’t want to argue with blind Tesla fanbois who refuse to believe anything other than what fits their own narrative from Motley Fool and whatever crap subReddit they chat on.

And yes, you are correct in your calculations, and yes, they are incorrect in their beliefs. Then again, they’re probably the people that think a week on Robinhood is better than getting a Series 7.

ttyymmnn

> PatBateman

ttyymmnn

> PatBateman

08/12/2020 at 13:55 |

|

BRB, warming up the time machine.

hillrat

> PatBateman

hillrat

> PatBateman

08/12/2020 at 13:56 |

|

I’m sorry, I’m still stuck on the $11k vs $550k in market cap per vehicle sold. I’m not sure what that actually means, but my intuitive sense is that it means Tesla’s stock is crazily overvalued by speculators.

Who gets caught without a chair if/ when the music stops (speculative bubble pops) on this one?

Arch Duke Maxyenko, Shit Talk Extraordinaire

> PatBateman

Arch Duke Maxyenko, Shit Talk Extraordinaire

> PatBateman

08/12/2020 at 13:56 |

|

Before becoming a ______ he used to work for ______ as an engineer.

PatBateman

> I like cars: Jim Spanfeller is one ugly motherfucker

PatBateman

> I like cars: Jim Spanfeller is one ugly motherfucker

08/12/2020 at 13:58 |

|

If someone is willing to buy a two year old Model X for $150,000, who am I to argue? /s

The stock market as a whole isn’t fake by any means. It reflects ownership in companies and what people are willing to pay/sell that ownership for. Prices USUALLY reflect reasonable expectations of future earnings, past earnings, and a pinch of speculation, but then there are other times where all that crap goes out the window and investors either illogically hate or love a stock so much that it drives the share price to a place it shouldn’t be.

Cult and Pariah stocks, if you will.

nermal

> PatBateman

nermal

> PatBateman

08/12/2020 at 14:01 |

|

Pro tip: Do not try to reason with something that is unreasonable.

PatBateman

> hillrat

PatBateman

> hillrat

08/12/2020 at 14:02 |

|

Who gets caught without a chair if/when the music stops (speculative bubble pops) on this one?

IF there is a sudden correction of the stock price, w hoever is holding the stocks and doesn’t sell at a profit will be left out in the wind. Not a lot of other real big exposure.

SBA Thanks You For All The Fish

> PatBateman

SBA Thanks You For All The Fish

> PatBateman

08/12/2020 at 14:04 |

|

Hey, through the magic of modern auto tech we can give you all that PLUS the ability, with our exposed structural “exoskeleton”, to turn an ordinary parking fender-bender into a “total your truck out” event.

Eric @ opposite-lock.com

> hillrat

Eric @ opposite-lock.com

> hillrat

08/12/2020 at 14:17 |

|

It is ridiculously overvalued by speculators. The same is going on with tech stocks, but to a much smaller degree (their P/E ratios are still ridiculous, so I’d call those a bubble as well ) .

Everyone is blowing bubbles on top of bubbles with the money sloshing around the economy at this point.

PatBateman

> Arch Duke Maxyenko, Shit Talk Extraordinaire

PatBateman

> Arch Duke Maxyenko, Shit Talk Extraordinaire

08/12/2020 at 14:19 |

|

So the manager that initially hired me into the industry I’m in told me that he had interviewed three engineers who had decided that they would make great professional investors/advisors because they had really well on their own investments while day trading. The manager told each of them that he wouldn’t hire them, because he’d have to fire them within 6 months. Each of the engineers were befuddled and asked why. The answer: You are an introvert who sits in front of their computer all day. How are you going to get your clients?

With that said, I do have a few peers that were previously very extroverted engineers and they do very well for themselves. Luckily, they don’t get “lost in the woods” with the details on every single damned issue (that’s one of the things that makes them successful).

PatBateman

> SBA Thanks You For All The Fish

PatBateman

> SBA Thanks You For All The Fish

08/12/2020 at 14:21 |

|

Hopefully, some stout front end replacement brush guards and rear wrap around bumpers will be available quickly. Should be fun the first time someone keys it with enough effort.

Or throws a baseball at the windows.

SBA Thanks You For All The Fish

> PatBateman

SBA Thanks You For All The Fish

> PatBateman

08/12/2020 at 14:24 |

|

You raise a good point... After market “complete-surround bull bars” probably become a thing— to protect the super-strong, super-resilient stainless steel exoskeleton.

PatBateman

> nermal

PatBateman

> nermal

08/12/2020 at 14:24 |

|

Texas version of that pro-tip: Never wrestle with a pig. All that happens is you get muddy and the pig has fun.

PatBateman

> SBA Thanks You For All The Fish

PatBateman

> SBA Thanks You For All The Fish

08/12/2020 at 14:27 |

|

I mean, if you don ’t “ invest” $5k o n your vehicle to protect it from being totaled after a 10 mph fender bender/value ender, do you even drive a cool truck?

hillrat

> PatBateman

hillrat

> PatBateman

08/12/2020 at 14:27 |

|

Let me refine my questions further, are there defined constituencies (well known funds or activist investors/groups) out there that may be over-invested in Tesla that will get killed in a correction?

PatBateman

> hillrat

PatBateman

> hillrat

08/12/2020 at 14:33 |

|

None that the average person/non-qualified investor is invested in. Maybe some private equity or hedge funds have a high percentage of their pools in TSLA (I don’t have any examples, nor do I know if there are actually any hedge funds that do), but mutual funds have rules about how much of one stock they can own. This rule, even for the most pro-TSLA money manager, will prohibit them from putting all their eggs in one Musky basket.

hillrat

> PatBateman

hillrat

> PatBateman

08/12/2020 at 14:41 |

|

Great answer, thanks.

Eric @ opposite-lock.com

> PatBateman

Eric @ opposite-lock.com

> PatBateman

08/12/2020 at 14:48 |

|

The problem I have is that the majority of the market is extremely overvalued by historic standards. I don’t know how marginal earnings can be for how long before the thing collapses, but it’s also the only place remaining with any returns at all at this point, driving ever more money into the market. Of course I have a lot of money in the market, but that’s because there isn’t any other realistic choice.

This is what we'll show whenever you publish anything on Kinja:

> PatBateman

This is what we'll show whenever you publish anything on Kinja:

> PatBateman

08/12/2020 at 15:03 |

|

I’m a stock dummy, but my better half asked where I thought we should invest. I replied, she invested, and we’ve tripled our investment in 8 months.

Not too shabby.

PatBateman

> Eric @ opposite-lock.com

PatBateman

> Eric @ opposite-lock.com

08/12/2020 at 15:05 |

|

I’ve honestly been hearing the same thing for the past two decades from some people: the market is overinflated, it will come crashing down, there’s a day of reckoning coming, etc. And I promise I’m not picking on you at all, but I have heard the same exact people saying the same exact thing for literally twenty years. And they’ve been wrong every time.

Usually they point to historic Schiller PE ratios as proof, but that represents past PE ratios and doesn’t take into account the innovation that has been occurring since the dot com boom. Most people don’t get the access to information and reports about what’s going on in almost every facet of global business that I do, but let me tell you: there’s some amazing things that are occurring, and they’ve been driving up values on companies since the early 1990s. Some companies have failed on that front (Pets.com, Enron, etc), but enough have stuck around to truly transform the future.

Keep doing what you’ve been doing, and depending on your goals, take appropriate risk in your portfolio. Don’t be the guy I know that corners me in the stairwell and talks about how he’s been the smart one by keeping his money in bank CDs instead of normal investments since 1995.

PatBateman

> This is what we'll show whenever you publish anything on Kinja:

PatBateman

> This is what we'll show whenever you publish anything on Kinja:

08/12/2020 at 15:09 |

|

Nice. Did you sell?

Future next gen S2000 owner

> PatBateman

Future next gen S2000 owner

> PatBateman

08/12/2020 at 15:12 |

|

I think we should have all the stock certificates lying on the floor of the exchange and make the traders fight for them. Whomever comes up with the most wins. We then bet on the traders.

Seems basically like the same thing.

This is what we'll show whenever you publish anything on Kinja:

> PatBateman

This is what we'll show whenever you publish anything on Kinja:

> PatBateman

08/12/2020 at 15:12 |

|

Indeed, a fair chunk anyway. It's still climbing so we didn't want to offload it all, but a bird in the hand...

ZHP Sparky, the 5th

> PatBateman

ZHP Sparky, the 5th

> PatBateman

08/12/2020 at 16:43 |

|

Heads explode when you ask what changed between a few months ago when they were in the $300s and now at over $1500. Really, really - what new information did we learn that explains a 5x increase in stock price? I guess the realization that there are more fanbois and “investors” who like making unfounded decisions with their money?

Eric @ opposite-lock.com

> PatBateman

Eric @ opposite-lock.com

> PatBateman

08/12/2020 at 18:21 |

|

I have to disagree with you on the first point. I’ve been hearing it for 25+ years and they were right a few times in that period . Ultimately, it’s just more capital chasing fewer and smaller returns, which comes back around to my original thought that what keeps it up is that we have no other choice. FDIC insured savings accounts have been returning less than inflation for over a decade now.

Oh, I’m definitely not that person. Even with that dip earlier this year (starting to worry another is imminent), I’m up by quite a bit this year. My last couple decades of returns averages somewhere around 12% thanks to my contrarian investing during the 2007-2008 downturn - when all my coworkers were pulling back on their retirement savings and moving to bonds , I allocated mine in the most risky assets that were getting hammered even though it looked like a black hole at the time . It meant I didn’t miss the bottom and it grew all the way back up.

I work in tech and don’t trust the marketing. The next thing we know, the cash cows that tech companies are milking will be so heavily regulated that we’ll end up with razor thin margins like the energy sector.

PatBateman

> ZHP Sparky, the 5th

PatBateman

> ZHP Sparky, the 5th

08/12/2020 at 18:34 |

|

cYbEr TrUcK wIlL bE tHe BeSt TrUcK EvAh TsLa To OnE tRiLlIoN!!!11!

PatBateman

> Eric @ opposite-lock.com

PatBateman

> Eric @ opposite-lock.com

08/12/2020 at 18:44 |

|

What your coworker s did in 2008? That’s what’s called the “contagion” signal. It ’s when every normal investor says something like “I have to stop the bleeding”, or “I will be ruined if I don’t sell now!!” and immediately start dumping investments indiscriminately. My firm has an indicator for contagion signals, and it’s fantastic. Bull markets are born on PESSIMISM, grow on SKEPTICISM, mature on OPTIMISM and die on EUPHORIA; a lot of people are pretty skeptical nowadays.

There’s a lot of good things about my firm (which is a large firm, that I won’t name because I’m on a car blog typing random things and won’t dox myself nor my company), but one of them is that our research/analytics department is awesome. We don’t let marketing bias our thoughts on what is good or what’s bad for our clients’ money. Tech is a crowded play, but there’s a lot of companies that are on the cutting edge of innovation. Those will definitely go farther than the rest of the crowd (and energy).

PatBateman

> Future next gen S2000 owner

PatBateman

> Future next gen S2000 owner

08/12/2020 at 18:46 |

|

I’m a pretty strong guy and can handle myself in the scrum. BRING ON THE FLOOR TRADER DEATH MATCH!!!

Future next gen S2000 owner

> PatBateman

Future next gen S2000 owner

> PatBateman

08/13/2020 at 09:44 |

|